Home Warranty vs. Home Insurance – Know the Difference!

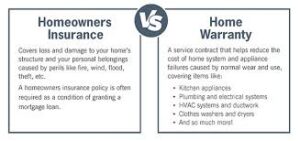

When it comes to protecting your home, you might hear about both home warranties and home insurance—but do you really know how they differ? Understanding the difference can save you money, prevent coverage gaps, and ensure you’re properly protected against unexpected expenses.

Let’s break down what home warranties and home insurance cover, how they work, and which one you might need.

What Is Home Insurance?

Home insurance (also called homeowner’s insurance) is a policy that protects your home and belongings against major risks such as:

-

Fire

-

Theft

-

Vandalism

-

Natural disasters like storms or hail

-

Liability for accidents occurring on your property

If your house suffers damage or your belongings are stolen, home insurance helps pay for repairs or replacements—often after you pay a deductible.

What Is a Home Warranty?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances that break down due to normal wear and tear. These typically include:

-

HVAC systems (heating and air conditioning)

-

Plumbing

-

Electrical systems

-

Kitchen appliances like refrigerators, ovens, and dishwashers

-

Water heaters

Home warranties don’t protect against damage from accidents or disasters—they focus on system and appliance breakdowns.

Key Differences Between Home Warranty and Home Insurance

| Feature | Home Insurance | Home Warranty |

|---|---|---|

| Coverage | Damage from accidents, theft, natural disasters, liability | Repairs or replacement of appliances and home systems due to wear and tear |

| What’s Protected | House structure, personal belongings, liability | Appliances and home systems (HVAC, plumbing, electrical) |

| When It Pays | After damage from covered events | When appliances or systems fail due to normal use |

| Cost | Premiums based on home value, location, coverage | Annual or monthly service contract fees |

| Claims Process | File claim after damage, insurer pays for repair or replacement | Contact warranty company for service call; pay service fee for repairs |

Do You Need Both?

Many homeowners benefit from having both home insurance and a home warranty, since they cover different risks:

-

Home insurance protects your investment from major disasters and theft.

-

Home warranty helps you avoid costly repair bills when appliances or systems break down unexpectedly.

If you own an older home or appliances, a home warranty can be especially valuable. For new homeowners, insurance is mandatory for mortgage lenders, while home warranties are optional but offer extra peace of mind.

When Home Insurance Alone Isn’t Enough

Imagine a sudden furnace breakdown in the middle of winter or a faulty dishwasher flooding your kitchen. These appliance failures typically aren’t covered by home insurance but can result in expensive repairs or replacements.

A home warranty covers these scenarios, helping you budget for unexpected expenses without breaking the bank.

Important Tips When Choosing Coverage

-

Review What’s Covered: Home warranties differ in what systems and appliances are included. Check the fine print carefully.

-

Understand Exclusions: Neither policy covers everything—know what’s excluded. For example, home warranties often exclude pre-existing conditions.

-

Compare Costs and Benefits: Balance the cost of premiums or service fees with your home’s age and your budget.

-

Check Service Provider Reputation: For home warranties, the quality and speed of repair services matter.

Final Thoughts

Both home insurance and home warranties play important roles in protecting your home and finances, but they serve very different purposes. Home insurance guards against disasters and liability, while a home warranty shields you from costly repairs when appliances or systems fail.

Understanding these differences empowers you to make informed decisions about protecting your home. For many, having both is the best way to avoid surprises and maintain peace of mind.