Co-Insurance and Deductibles: What You’re Actually Paying

When it comes to insurance, terms like co-insurance and deductibles often confuse policyholders. Understanding these concepts is key to knowing what you’re really paying for and how your insurance works when you file a claim. Let’s break down what co-insurance and deductibles mean, how they impact your costs, and what you should watch out for.

What Is a Deductible?

A deductible is the amount of money you agree to pay out-of-pocket before your insurance coverage kicks in. Think of it as your share of the cost before the insurer starts paying.

For example, if your deductible is $500 and you have a claim for $2,000, you pay the first $500, and your insurance covers the remaining $1,500.

Types of Deductibles:

-

Fixed amount deductible: A set dollar amount per claim or per policy period.

-

Percentage deductible: A percentage of the insured value, often used in property insurance.

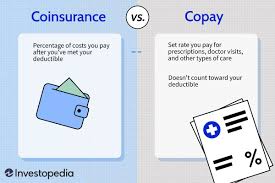

What Is Co-Insurance?

Co-insurance refers to the percentage of a covered loss that you must pay after the deductible has been met. It’s a shared cost between you and the insurer.

For instance, if your co-insurance is 20%, and you have a covered loss of $10,000 (after paying your deductible), you would pay $2,000, and the insurer pays $8,000.

How Do Deductibles and Co-Insurance Work Together?

When you make a claim, the process usually goes like this:

-

You pay the deductible first.

-

The insurer covers the remaining amount, minus your co-insurance share.

Example:

-

Total loss: $10,000

-

Deductible: $1,000

-

Co-insurance: 20%

You pay the $1,000 deductible plus 20% of the remaining $9,000 ($1,800), totaling $2,800 out of pocket. The insurer pays the rest ($7,200).

Why Do Insurers Use Deductibles and Co-Insurance?

These cost-sharing measures help:

-

Keep premiums more affordable

-

Encourage policyholders to avoid small or frequent claims

-

Share risk between insurer and insured

What Should You Know to Avoid Surprises?

1. Read Your Policy Carefully

Deductibles and co-insurance percentages vary by policy type and insurer. Make sure you understand the specific terms.

2. Know Your Coverage Limits

Co-insurance penalties can apply if you underinsure your property or asset.

3. Prepare for Out-of-Pocket Costs

Even with insurance, deductibles and co-insurance mean you’ll pay part of the claim.

4. Ask About Ways to Lower Your Costs

Increasing your deductible might reduce premiums but increases your out-of-pocket risk. Balancing this is key.

Co-Insurance Clauses: The Hidden Risk

In some property insurance policies, co-insurance clauses require you to insure your property to a certain percentage (often 80%-100%) of its value. Failing to do so can result in significant penalties during claims.

For example, if you insure only 70% of your property’s value but your policy requires 80%, your claim payout could be reduced proportionally—even if you have coverage.

Final Thoughts

Understanding deductibles and co-insurance is essential for making smart insurance decisions and avoiding unexpected costs. These terms define how much you pay out of pocket and how claims are shared between you and your insurer.

Before purchasing or renewing any insurance, take time to review your policy’s deductible and co-insurance terms. If you have questions or need help adjusting your coverage, consulting an insurance professional can make all the difference.