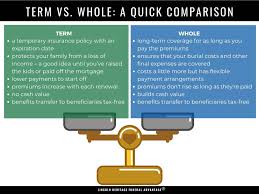

When choosing life insurance, one of the first decisions you’ll face is whether to buy term life insurance or whole life insurance. Both provide financial protection, but they operate very differently—and understanding the distinction is crucial to making the right choice for your family and financial goals.

Term Life Insurance

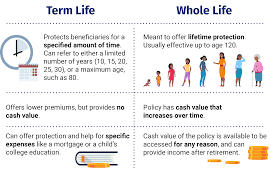

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If the insured passes away during that term, the beneficiaries receive a death benefit.

Key Features:

- Lower Premiums – Because it only covers a set period, term insurance is generally cheaper.

- Temporary Coverage – Ideal for covering debts, mortgages, or a family until children are grown.

- No Cash Value – Term insurance does not accumulate any savings or investment component.

Pros:

- Affordable and straightforward.

- Easy to understand and compare.

Cons:

- Coverage expires at the end of the term.

- If you outlive the policy, you get no payout unless you renew (usually at higher rates).

Whole Life Insurance

Whole life insurance provides coverage for your entire life, as long as premiums are paid. In addition to the death benefit, it builds cash value, which you can borrow against or use in the future.

Key Features:

- Lifetime Coverage – Guarantees a payout upon death.

- Cash Value Component – Part of your premium grows over time as a tax-deferred savings.

- Fixed Premiums – Payments remain level throughout the life of the policy.

Pros:

- Permanent protection with guaranteed death benefit.

- Cash value can supplement retirement or emergencies.

Cons:

- More expensive than term insurance.

- Less flexible for those seeking temporary coverage.

Choosing Between Term and Whole Life

The choice depends on your financial goals, budget, and coverage needs:

- Term Insurance – Best for temporary needs like mortgages, education, or short-term family protection.

- Whole Life Insurance – Best for lifelong protection, estate planning, or building cash value over time.

The Bottom Line

Term and whole life insurance serve different purposes. Term is cost-effective and straightforward, while whole life provides long-term security and a savings component. Understanding the real differences ensures that your life insurance aligns with your financial goals and protects your loved ones effectively.